Four years ago, I decided to make 2020 my year of health. I didn’t set out to complete specific goals like losing a certain amount of weight or work out a certain number of times a week. I just wanted to be a healthier person overall.

I had no idea that a pandemic would upend daily life as we knew it a few months into 2020, but the changes the pandemic brought, namely working from home, actually ended up helping me in my journey once I changed my expectations of what being a healthier person looked like.

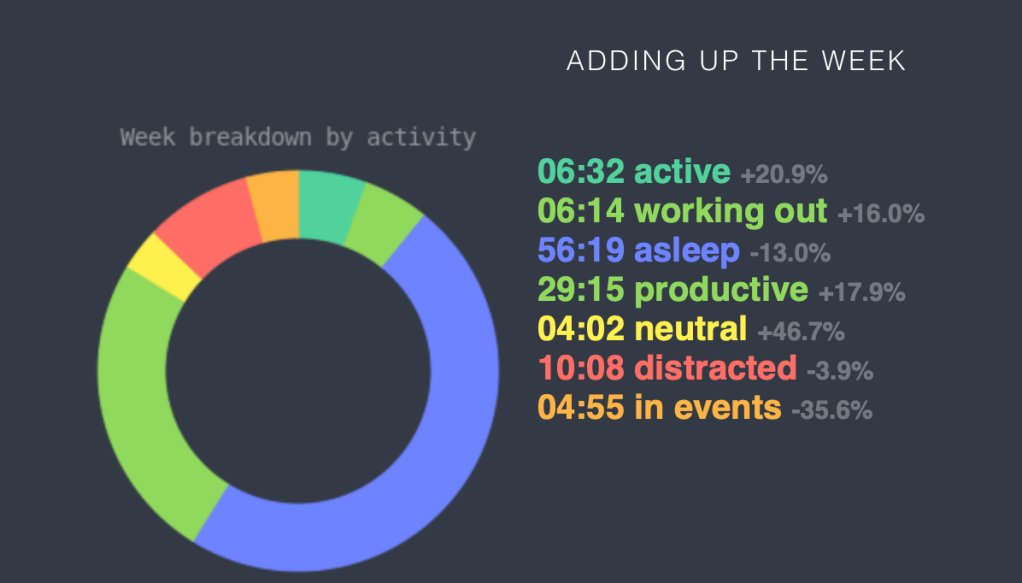

Pre-pandemic, my “exercise” consisted of small things throughout the day like taking the stairs, parking further away, and taking a walk during my lunch break if the weather was nice. It wasn’t much, but it was something. Of course, those things all went away once I started working from home. Three months into my year of health, I found myself averaging a dismal 1 minute of exercise per day according to my Apple Watch. Needless to say, my year of health wasn’t off to the greatest start, and I knew something had to change.

I started by taking a page from James Clear’s Atomic Habits, and set a small goal of adding one minute to my daily exercise average. It was around this time that I also signed up for a free trial with Apple Fitness + which gave me access to workouts I could do from home. This was still in the early days of Apple Fitness + where the back catalog wasn’t all that large, so I quickly worked through the cycling classes and found myself exploring the other types of workouts so that I wasn’t repeating workouts. I added strength, core, yoga and later Pilates to my weekly routine. Variety improved my fitness in general, but also kept things interesting and gave me options for when I wasn’t feeling a particular workout. Within a few weeks, I actually started to see myself as someone who not only worked out regularly but wanted to.

I’m happy to say that despite a number of curveballs in the years since, including a sprained ankle, an unexpected trip to the ER, and not one but two heart surgeries in 2022 along with several other hurdles in my personal life, I’ve stayed committed to my health. In 2023, I even managed a workout streak of 230 straight days, and I owe a big part of that to adding variety into my workouts (a tip I picked up from Stephen Guise’s Elastic Habits.)

For 2024, as part of my theme of investment, I’m returning to my original focus of just being a healthier person in general. While I spent 2023 focusing on maintaining a streak, I don’t really care about the numbers this year. I don’t want to beat myself up for missing a workout or adjusting my plans when I’m just not feeling it or life gets in the way. I just want to take care of my body.

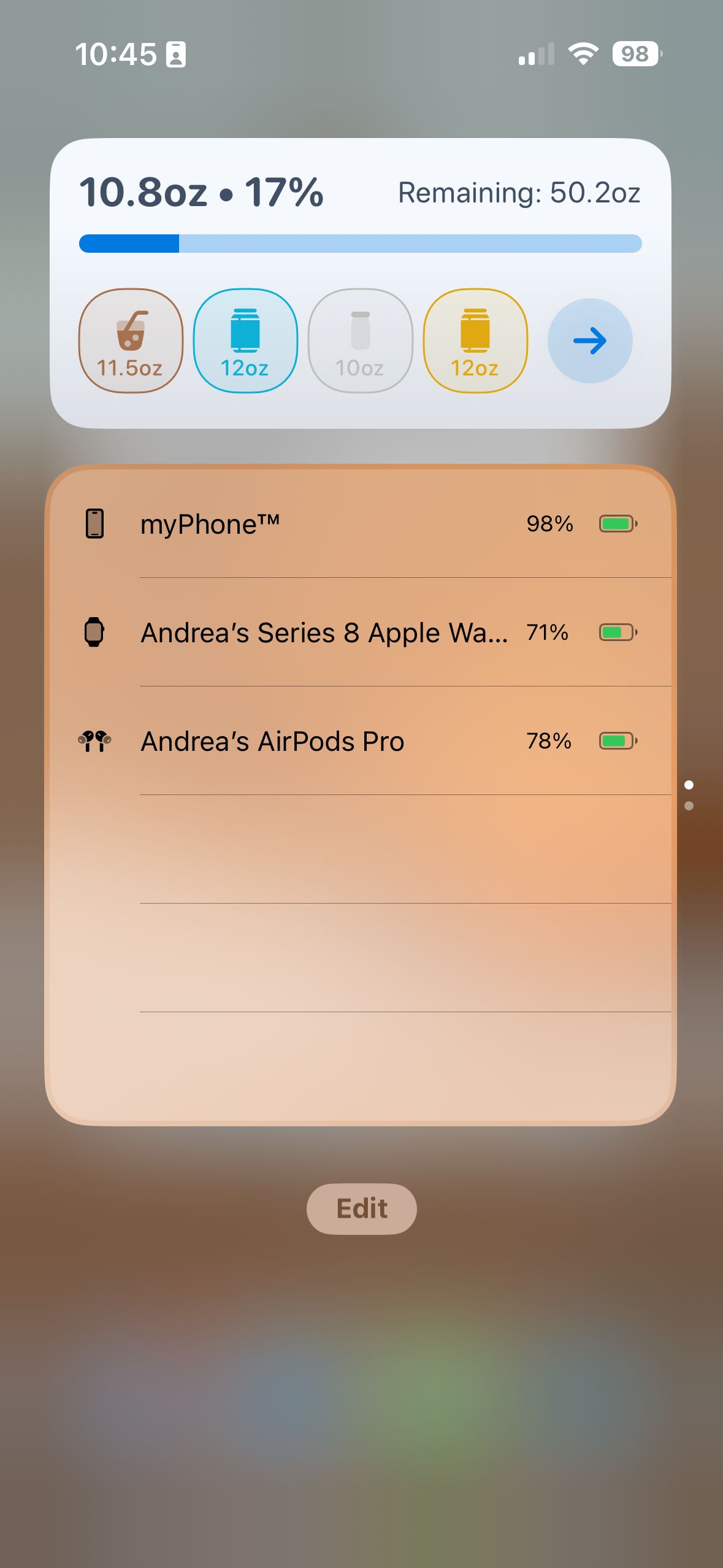

As I write this, I’m currently averaging about 40 minutes of exercise a day – way up from the 1 minute I started with back in 2020.

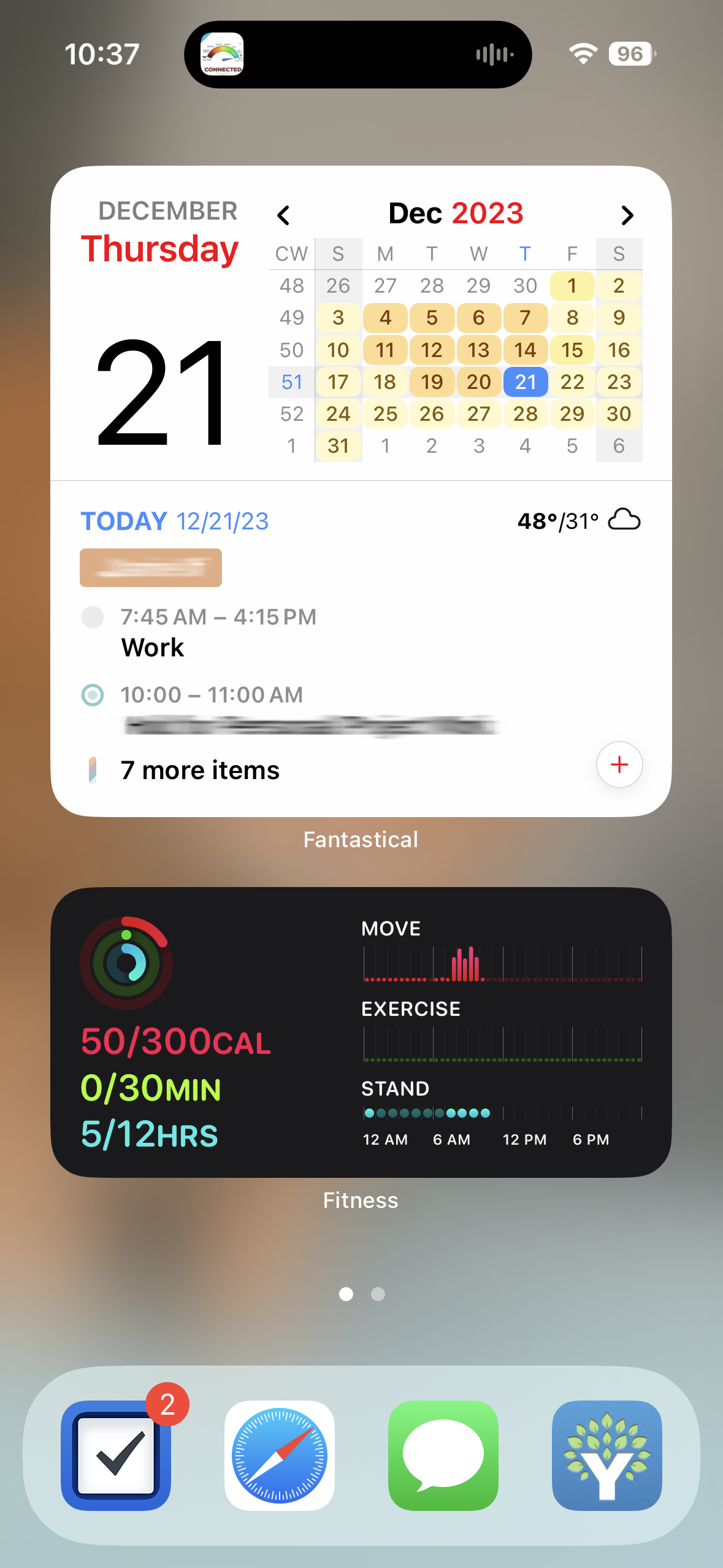

Thanks to Apple Fitness’s new custom plan feature, I also no longer need to plan out my workouts in Things each Friday as part of my weekly review. Apple does that for me, and I only need to reconfigure my plan every few weeks once the existing one expires or I decide to change my routine. (Apple, if you’re listening, please let us reuse with the same routine but using new workouts and let us edit them.)

Because I’m less focused on a daily workout streak, I tend to take Saturdays and Sundays off these days. Not wanting to decrease my overall time working out, during the week, I try to do some sort of workout in the afternoon, and then usually do another shorter workout in the afternoon. If I’m ever not feeling it though, I swap workouts or skip the evening workout. Right now, my current routine looks a bit something like this:

- Mondays: 10 minutes of Core + 20 minutes of Upper Body Strength + 10-20 minutes of Yoga in the evening

- Tuesdays: 30-45 minutes of Cycling + 10-20 minutes of Yoga in the evening

- Wednesdays: 10 minutes of Core + 20 minutes of Lower Body Strength + 10-20 minutes of Yoga in the evening

- Thursdays: 30-45 minutes of Cycling + 10-20 minutes of Yoga in the evening

- Fridays: 30 minutes of Pilates or Total Body Strength and 20 minutes of Cycling

- Saturdays: 30 minutes of HIIT (optional)

- Sundays: 45 minutes of Yoga (optional)

In addition to Apple Fitness +, I am also using the app Gentler Streak to avoid pushing too hard. When I started using the app, I wasn’t fully convinced or listening when it told me to ease up, but after 4 months of using it, I have to admit, it’s been pretty spot on in warning me when I might need to ease up. If and when I’ve ignored the app’s suggestions to go “gentler”, I’ve realized the tell tale signs of burnout creeping up about a week later and find myself wanting or needing to take an even longer break. When I do listen to it, I notice my fitness improving.

Health and fitness these days is less about me wanting to look a certain way or meeting a certain goal. I try not to fret about missing a workout or needing to adjust my plan when life gets in the way. Instead, I focus on how regular activity or rather the lack of regular activity makes me feel. I start to feel disheveled and lazy in other areas of my life. I’m less productive. I drop the ball on chores. I snack more, and I find myself drawn towards sitting on the couch watching TV or scrolling Instagram. Much like I’ve discovered with productivity, fitness is not about trying to do the most all the time. It’s doing some form of activity, no matter how small, consistently that leads to sustainable progress.